Don't miss out on local tips, events and market insights.

CLICK PLAY FOR YOUR LATEST MARKET UPDATE

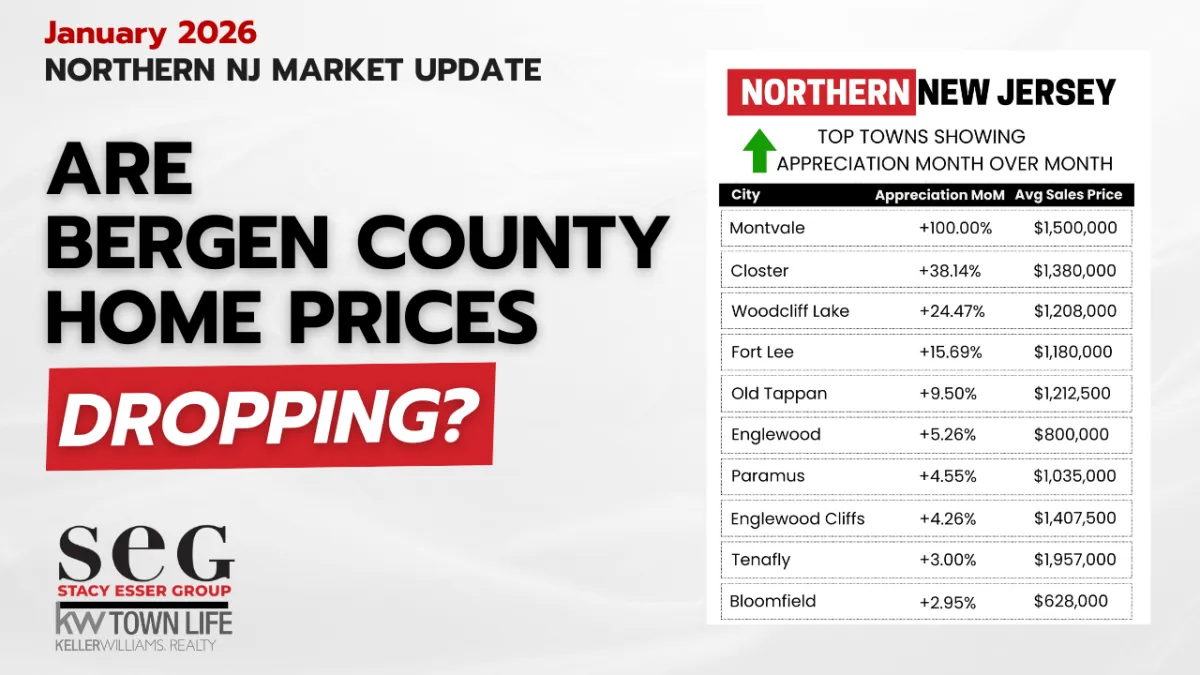

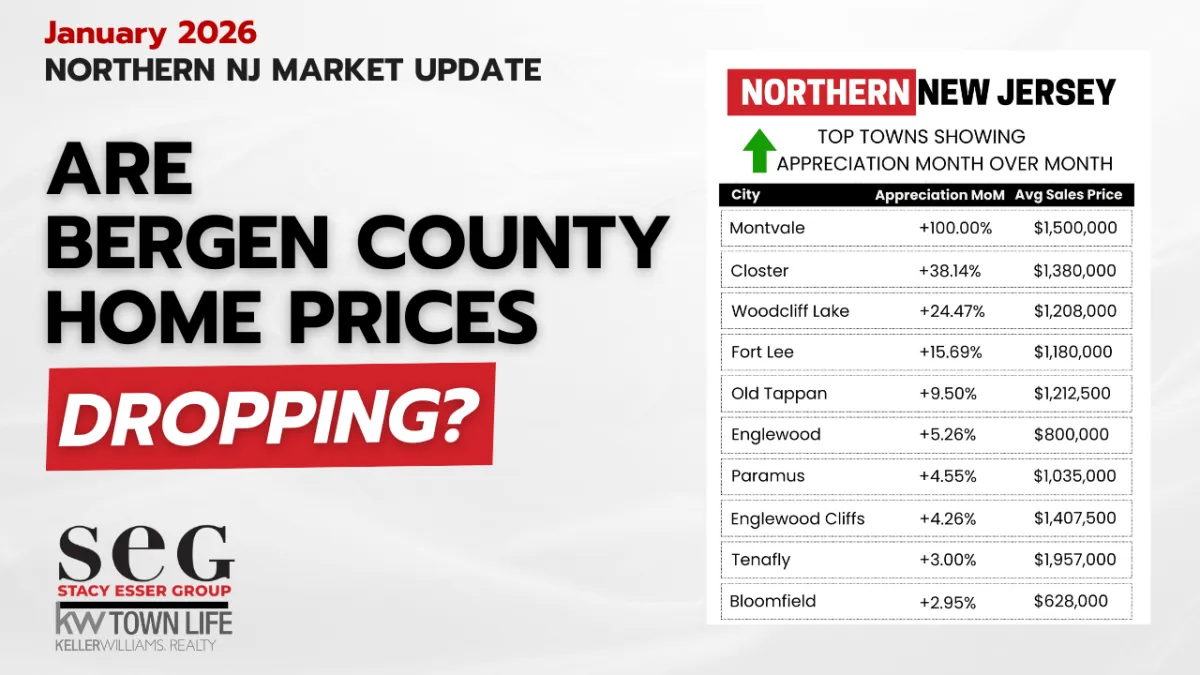

For Northern NJ | January, 2026

Hope you got value from our market update. If you ever want the specifics for your neighborhood, send us an email and we'll share the data with you.

More Market Updates in Your Area!

Is Bergen County Real Estate Cooling Off? 2026 Market Update

Bergen County Real Estate Market Overview for 2025–2026

The frenzy of 2021–2022 has certainly evolved, but that does not mean the market is weak. As we enter 2026, data pulled directly from the MLS shows:

Home prices remain strong across most segments

Inventory is still limited

Buyer demand continues to outweigh supply

Days on market remain relatively low

Mortgage rates are trending down

This combination continues to favor sellers—though strategy matters more than ever.

Bergen County Home Prices Remain Strong

Despite higher interest rates over the past two years, Bergen County home prices have not dropped. In fact, sold home prices are up across most towns.

We are also seeing:

Growth in condos and townhomes

A resilient luxury market

Selective price reductions on homes that are overpriced or poorly marketed

The key distinction is this: well-priced, well-marketed homes are still selling quickly and at strong prices.

Days on Market in Bergen County: Speed Still Matters

One of the clearest indicators of market strength is days on market:

Most homes are selling in under 40 days

Well-priced, well-prepared homes often sell in under 30 days

Overpriced homes are sitting 60+ days and chasing the market down

For sellers, speed creates competition—and competition drives price.

For buyers, a home sitting longer than 60 days often signals a pricing or value misalignment, creating negotiation opportunities.

Bergen County Inventory Levels Continue to Be the Pressure Point

Inventory remains the single biggest factor keeping the Bergen County housing market strong.

We are currently sitting at approximately 2.5 months of housing supply, meaning:

If no new homes came on the market, Bergen County would run out of inventory in about two and a half months.

This is not a balanced market. It’s a supply-constrained market that continues to support pricing—especially in towns closest to New York City and those with the easiest commutes.

Why Bergen County Home Prices Haven’t Dropped

Despite elevated interest rates in 2024 and early 2025, prices have held because:

There are more buyers than sellers

Desirable towns remain in extremely short supply

Demand is strongest closest to NYC

As we head into January 2026, mortgage rates are now at their lowest levels in over a year, bringing even more buyers back into the market.

Mortgage Rates, Buyer Power, and Timing the Market

Mortgage rates peaked above 7% in 2023–2024, which slowed activity and caused hesitation. As rates improved:

Buyer confidence returned

Buying power increased

Competition intensified

A 1% drop in interest rates can equal roughly 10% more buying power. This is why homes are now selling at 103–104% of asking price when priced correctly.

Advice for Sellers in the Bergen County Market

Even in a seller-favored market, strategy is critical. Simply putting a sign in the yard and taking poor-quality photos can cost sellers real money.

The biggest mistake sellers make is leaving money on the table by not investing in:

Proper pricing

Strong presentation

A clear marketing strategy

Programs like the Value Up Method help sellers maximize their home’s value—even in a strong market—by focusing on preparation, positioning, and execution.

Advice for Buyers: Don’t Wait Without a Plan

Waiting until spring often means:

More buyers entering the market

More competition

Stronger cash offers

More waived contingencies

Buyers who wait without a strategy often find themselves losing bidding wars. Programs that help buyers compete like cash buyers—even if they need to sell a home first—can be game changers in this environment.

The Real Opportunity in Bergen County Real Estate for 2026

This is no longer a guessing market—it’s a thinking market.

The buyers and sellers who achieve the best outcomes will not be the fastest or the loudest. They will be:

The most informed

The best prepared

The most strategic

Local expertise, data-driven pricing, and professional guidance make the difference.

Thinking About Buying or Selling in Bergen County?

Every situation is unique. Whether you’re buying, selling, or just planning ahead, understanding your specific town and price point is essential.

📞 Call or text: 201-292-0011

📅 One-on-one strategy sessions available here.

Upcoming Luxury

Open Houses

⬇️Get access to Privately Listed Homes For Sale ⬇️

Many sellers choose to list their homes privately before they go public. We have access to 45+ homes for sale in our office exclusives. Don't miss out on the home of your dreams because someone else saw it first. Get access!

Hurry, these spectacular homes go fast!

100% Secure. We value your privacy.

By submitting your email and phone number in the forms on our site, you give

consent to receiving occasional emails and SMS text messages about offers,

or other information, from us.

what's happening around town!

Latest around Northern NJ

Buyers Locked Out of Market

Featured on CBS Mornings, The Buyer struggle across Bergen, Passaic and Hudson County

5 Reasons NOT to Move to Northern NJ in 2024

We'll discuss 5 important factors to consider before making the move to Northern NJ!

Don't Sell Until You Watch this!

Learn 3 Simple ways to know it's time to sell your home! And spoiler alert - it's not the most obvious!

Sell Your Home for Top Dollar in Northern NJ!

How to sell your home for the most money as featured on NBC Today

Upgrading Your Home? Don't do this!

Planning to upgrade your home? 🏠 Before you dive in, make sure to avoid these common mistakes that could negatively impact your home's value!

What you need to know about NAR!

If you are buying in NJ, this video will share exactly what you need to know about hiring a buyers agent!

Top Appreciating Towns

Top 3 Local Event Picks

What's Happening This Month in Northern NJ!

Get our Free Guide to

"Value-Up™ Your Home"

Our Value-Up™ Your Home eBook Was Written To

Give You A Better Understanding of how to transform your home's value in Northern NJ! Get Yours FREE today!

Available for a limited time!

Buying or Selling in Northern NJ? Don't miss out on our latest Fall SEGInsider - A full guide to the housing market in Northern NJ.

Report Cards by Town

Brought to you by Niche.com

Check out Niche's 2024 Best Places to Live in Bergen County here

Bergen County, NJ

Bergen County, New Jersey, has a population of 953,243 and is considered one of the best places to live in the state. Most residents own their homes, and the area offers many bars, restaurants, coffee shops, and parks. It attracts young professionals, with residents generally leaning liberal. The public schools in Bergen County are highly rated.

Tenafly, NJ

Tenafly, a suburb of New York City in Bergen County with a population of 15,299, is one of the best places to live in New Jersey. Most residents own their homes and enjoy a suburban feel with numerous restaurants, coffee shops, and parks. The town attracts families, and residents generally hold moderate political views. Tenafly’s public schools are highly rated.

Oradell, NJ

Oradell, a New York City suburb in Bergen County with a population of 8,208, is considered one of the best places to live in New Jersey. Residents enjoy a suburban feel, with most owning their homes. The town has plenty of coffee shops and parks and is popular among retirees. Oradell residents generally lean conservative, and the public schools are highly rated.

Hawthorne, NJ

Hawthorne, a suburb of New York City in Passaic County with a population of 19,456, offers a dense suburban feel with many restaurants, coffee shops, and parks. It attracts families and young professionals, with residents generally leaning liberal. The public schools are rated above average.

Demarest, NJ

Demarest, a New York City suburb in Bergen County with a population of 4,930, is considered one of the best places to live in New Jersey. It has a rural atmosphere, with most residents owning their homes. The community generally holds moderate political views, and the public schools are highly rated.

Closter, NJ

Closter, a New York City suburb in Bergen County with a population of 8,555, is highly rated as a place to live in New Jersey. It provides a rural feel, and most residents own their homes. The community tends toward moderate political views, and the public schools are highly rated.

Montvale, NJ

Montvale, a New York City suburb in Bergen County with a population of 8,413, is known as one of New Jersey’s top places to live. It offers a sparse suburban atmosphere, with most residents owning their homes. The area attracts many young professionals, and the community generally leans conservative. Montvale’s public schools are highly rated.

Upper Saddle River, NJ

Upper Saddle River, a New York City suburb in Bergen County with a population of 8,313, is highly rated as a place to live in New Jersey. It offers a rural feel, with most residents owning their homes and enjoying the town’s numerous parks. Residents tend to hold moderate political views, and the public schools are highly rated.

Woodcliff Lake, NJ

Woodcliff Lake, a New York City suburb in Bergen County with a population of 6,096, is highly regarded as a place to live in New Jersey. It provides a sparse suburban feel, with most residents owning their homes and enjoying many coffee shops and parks. The community leans conservative, and the public schools are highly rated.

Real Estate Insights, Home Tips & More

Is Bergen County Real Estate Cooling Off? 2026 Market Update

Bergen County Real Estate Market Overview for 2025–2026

The frenzy of 2021–2022 has certainly evolved, but that does not mean the market is weak. As we enter 2026, data pulled directly from the MLS shows:

Home prices remain strong across most segments

Inventory is still limited

Buyer demand continues to outweigh supply

Days on market remain relatively low

Mortgage rates are trending down

This combination continues to favor sellers—though strategy matters more than ever.

Bergen County Home Prices Remain Strong

Despite higher interest rates over the past two years, Bergen County home prices have not dropped. In fact, sold home prices are up across most towns.

We are also seeing:

Growth in condos and townhomes

A resilient luxury market

Selective price reductions on homes that are overpriced or poorly marketed

The key distinction is this: well-priced, well-marketed homes are still selling quickly and at strong prices.

Days on Market in Bergen County: Speed Still Matters

One of the clearest indicators of market strength is days on market:

Most homes are selling in under 40 days

Well-priced, well-prepared homes often sell in under 30 days

Overpriced homes are sitting 60+ days and chasing the market down

For sellers, speed creates competition—and competition drives price.

For buyers, a home sitting longer than 60 days often signals a pricing or value misalignment, creating negotiation opportunities.

Bergen County Inventory Levels Continue to Be the Pressure Point

Inventory remains the single biggest factor keeping the Bergen County housing market strong.

We are currently sitting at approximately 2.5 months of housing supply, meaning:

If no new homes came on the market, Bergen County would run out of inventory in about two and a half months.

This is not a balanced market. It’s a supply-constrained market that continues to support pricing—especially in towns closest to New York City and those with the easiest commutes.

Why Bergen County Home Prices Haven’t Dropped

Despite elevated interest rates in 2024 and early 2025, prices have held because:

There are more buyers than sellers

Desirable towns remain in extremely short supply

Demand is strongest closest to NYC

As we head into January 2026, mortgage rates are now at their lowest levels in over a year, bringing even more buyers back into the market.

Mortgage Rates, Buyer Power, and Timing the Market

Mortgage rates peaked above 7% in 2023–2024, which slowed activity and caused hesitation. As rates improved:

Buyer confidence returned

Buying power increased

Competition intensified

A 1% drop in interest rates can equal roughly 10% more buying power. This is why homes are now selling at 103–104% of asking price when priced correctly.

Advice for Sellers in the Bergen County Market

Even in a seller-favored market, strategy is critical. Simply putting a sign in the yard and taking poor-quality photos can cost sellers real money.

The biggest mistake sellers make is leaving money on the table by not investing in:

Proper pricing

Strong presentation

A clear marketing strategy

Programs like the Value Up Method help sellers maximize their home’s value—even in a strong market—by focusing on preparation, positioning, and execution.

Advice for Buyers: Don’t Wait Without a Plan

Waiting until spring often means:

More buyers entering the market

More competition

Stronger cash offers

More waived contingencies

Buyers who wait without a strategy often find themselves losing bidding wars. Programs that help buyers compete like cash buyers—even if they need to sell a home first—can be game changers in this environment.

The Real Opportunity in Bergen County Real Estate for 2026

This is no longer a guessing market—it’s a thinking market.

The buyers and sellers who achieve the best outcomes will not be the fastest or the loudest. They will be:

The most informed

The best prepared

The most strategic

Local expertise, data-driven pricing, and professional guidance make the difference.

Thinking About Buying or Selling in Bergen County?

Every situation is unique. Whether you’re buying, selling, or just planning ahead, understanding your specific town and price point is essential.

📞 Call or text: 201-292-0011

📅 One-on-one strategy sessions available here.