Don't miss out on local tips, events and market insights.

CLICK PLAY FOR YOUR LATEST MARKET UPDATE

For Northern NJ | December, 2025

Hope you got value from our market update. If you ever want the specifics for your neighborhood, send us an email and we'll share the data with you.

More Market Updates in Your Area!

Bergen County Real Estate Market Update: What’s Really Driving Home Prices in 2025?

Bergen County Home Prices Continue to Rise — But There’s More to the Story

Yes, Bergen County home prices are still climbing but as local Realtor Stacy Esser points out, looking at sold prices alone is like looking in the rearview mirror. To really understand what’s happening in today’s market, you have to look at leading indicators: price reductions, days on market, and buyer demand.

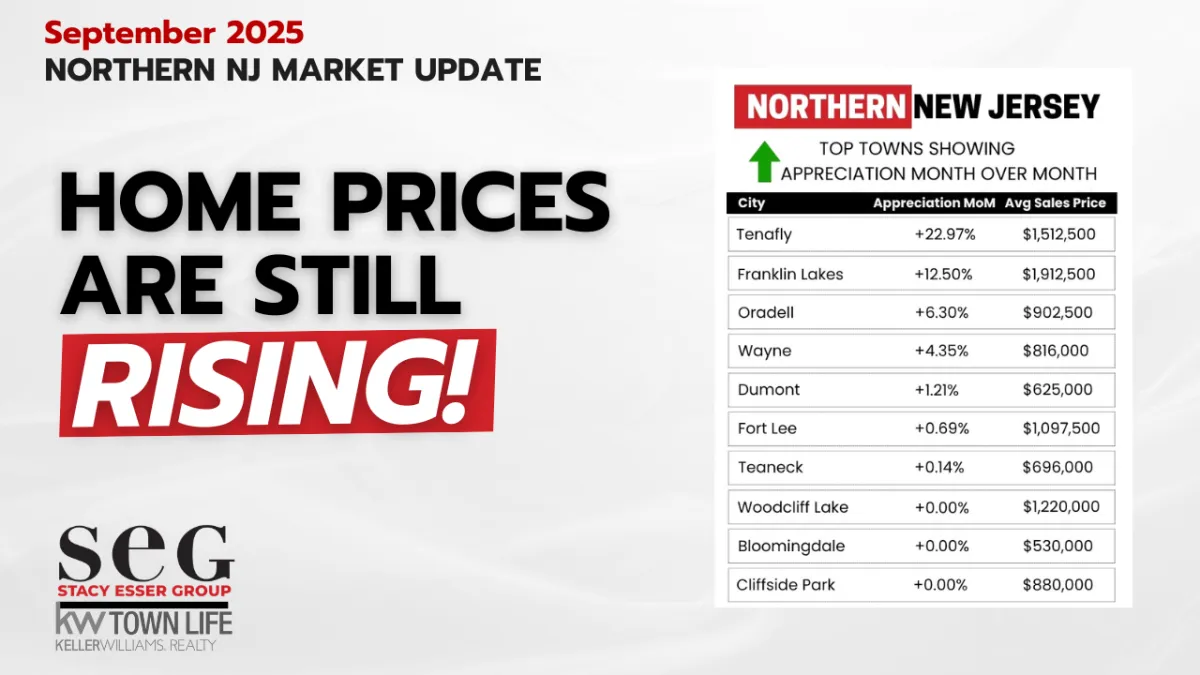

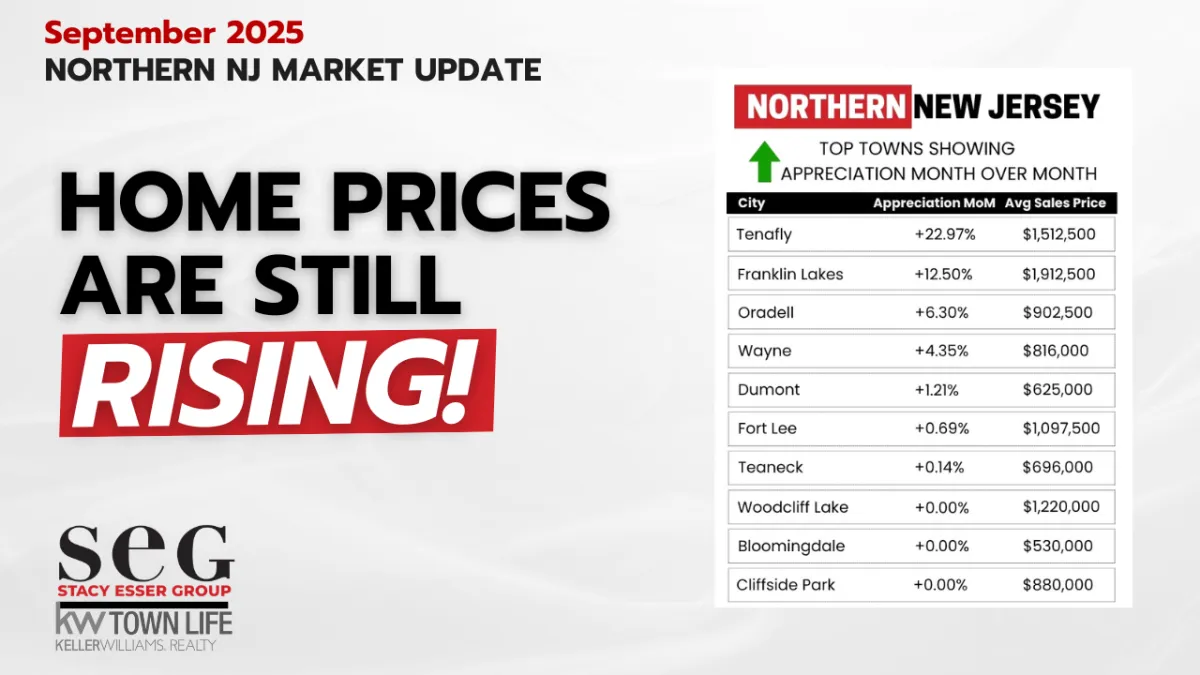

Through September 2025, average list and sold prices in Bergen County are both up about 12% year-to-date, with the median sold price increasing by roughly 10.4%. These numbers reflect a market that remains strong — but the data hides an important story beneath the surface.

What’s Really Driving the Bergen County Housing Market?

Behind those strong price increases, many sellers who don’t get their desired price are quietly taking their homes off the market rather than reducing. This “shadow inventory” makes it appear that sellers are firmly in control, when in reality, there’s a subtle tug-of-war happening between buyers and sellers.

Inventory remains exceptionally tight, which continues to place upward pressure on prices. Bergen County isn’t following the same trend as other national markets experiencing slowdowns — and the limited housing supply here is keeping things competitive.

Buyer Behavior: When the Price Is Right, Demand Follows

Homes that are priced correctly are still selling quickly and often above their listed prices. But when homes sit on the market longer, sellers are more likely to withdraw and re-list rather than negotiate.

This creates the illusion of a seamless market, but in truth, it’s a sign of buyer hesitation and affordability challenges. As days on market increase by 30–40 days in some cases, the market shows small but meaningful signs of cooling momentum — even as prices stay high.

Affordability Challenges and the Missing First-Time Homebuyer

The biggest shifts are happening among first-time buyers, who are struggling with affordability in Bergen County’s high-cost market. Many entry-level homes are being bought by developers, squeezing out younger buyers and contributing to the shortage of move-in-ready starter homes.

However, there’s a silver lining: mortgage rates are finally trending lower. As of mid-October 2025, average rates are around 6.25%, down from nearly 7% this time last year. This drop in rates could reignite buyer activity and make homeownership slightly more attainable particularly if the downward trend continues through the end of the year.

Looking Ahead: What Will Shift the Bergen County Real Estate Market?

Until inventory increases or affordability improves, Bergen County home prices are likely to remain stable or climb modestly. Lower interest rates could encourage more sellers to list and more buyers to enter the market, helping to balance supply and demand.

As Stacy explains, buyers don’t purchase a home price, they purchase a monthly payment. The moment those payments become more manageable, the local market could see a surge of new activity.

Key Takeaways for Bergen County Homeowners and Buyers

Prices remain strong: Up 10–12% year-over-year through September 2025.

Inventory is still tight: Keeping pressure on prices despite fewer active buyers.

Days on market are rising: Subtle signs of a market shift.

Affordability remains the biggest barrier for first-time homebuyers.

Falling mortgage rates could ease some of that pressure and spark renewed activity.

Upcoming Luxury

Open Houses

⬇️Get access to Privately Listed Homes For Sale ⬇️

Many sellers choose to list their homes privately before they go public. We have access to 45+ homes for sale in our office exclusives. Don't miss out on the home of your dreams because someone else saw it first. Get access!

Hurry, these spectacular homes go fast!

100% Secure. We value your privacy.

By submitting your email and phone number in the forms on our site, you give

consent to receiving occasional emails and SMS text messages about offers,

or other information, from us.

what's happening around town!

Latest around Northern NJ

Buyers Locked Out of Market

Featured on CBS Mornings, The Buyer struggle across Bergen, Passaic and Hudson County

5 Reasons NOT to Move to Northern NJ in 2024

We'll discuss 5 important factors to consider before making the move to Northern NJ!

Don't Sell Until You Watch this!

Learn 3 Simple ways to know it's time to sell your home! And spoiler alert - it's not the most obvious!

Sell Your Home for Top Dollar in Northern NJ!

How to sell your home for the most money as featured on NBC Today

Upgrading Your Home? Don't do this!

Planning to upgrade your home? 🏠 Before you dive in, make sure to avoid these common mistakes that could negatively impact your home's value!

What you need to know about NAR!

If you are buying in NJ, this video will share exactly what you need to know about hiring a buyers agent!

Top Appreciating Towns

Top 3 Local Event Picks

What's Happening This Month in Northern NJ!

Get our Free Guide to

"Value-Up™ Your Home"

Our Value-Up™ Your Home eBook Was Written To

Give You A Better Understanding of how to transform your home's value in Northern NJ! Get Yours FREE today!

Available for a limited time!

Buying or Selling in Northern NJ? Don't miss out on our latest Fall SEGInsider - A full guide to the housing market in Northern NJ.

Report Cards by Town

Brought to you by Niche.com

Check out Niche's 2024 Best Places to Live in Bergen County here

Bergen County, NJ

Bergen County, New Jersey, has a population of 953,243 and is considered one of the best places to live in the state. Most residents own their homes, and the area offers many bars, restaurants, coffee shops, and parks. It attracts young professionals, with residents generally leaning liberal. The public schools in Bergen County are highly rated.

Tenafly, NJ

Tenafly, a suburb of New York City in Bergen County with a population of 15,299, is one of the best places to live in New Jersey. Most residents own their homes and enjoy a suburban feel with numerous restaurants, coffee shops, and parks. The town attracts families, and residents generally hold moderate political views. Tenafly’s public schools are highly rated.

Oradell, NJ

Oradell, a New York City suburb in Bergen County with a population of 8,208, is considered one of the best places to live in New Jersey. Residents enjoy a suburban feel, with most owning their homes. The town has plenty of coffee shops and parks and is popular among retirees. Oradell residents generally lean conservative, and the public schools are highly rated.

Hawthorne, NJ

Hawthorne, a suburb of New York City in Passaic County with a population of 19,456, offers a dense suburban feel with many restaurants, coffee shops, and parks. It attracts families and young professionals, with residents generally leaning liberal. The public schools are rated above average.

Demarest, NJ

Demarest, a New York City suburb in Bergen County with a population of 4,930, is considered one of the best places to live in New Jersey. It has a rural atmosphere, with most residents owning their homes. The community generally holds moderate political views, and the public schools are highly rated.

Closter, NJ

Closter, a New York City suburb in Bergen County with a population of 8,555, is highly rated as a place to live in New Jersey. It provides a rural feel, and most residents own their homes. The community tends toward moderate political views, and the public schools are highly rated.

Montvale, NJ

Montvale, a New York City suburb in Bergen County with a population of 8,413, is known as one of New Jersey’s top places to live. It offers a sparse suburban atmosphere, with most residents owning their homes. The area attracts many young professionals, and the community generally leans conservative. Montvale’s public schools are highly rated.

Upper Saddle River, NJ

Upper Saddle River, a New York City suburb in Bergen County with a population of 8,313, is highly rated as a place to live in New Jersey. It offers a rural feel, with most residents owning their homes and enjoying the town’s numerous parks. Residents tend to hold moderate political views, and the public schools are highly rated.

Woodcliff Lake, NJ

Woodcliff Lake, a New York City suburb in Bergen County with a population of 6,096, is highly regarded as a place to live in New Jersey. It provides a sparse suburban feel, with most residents owning their homes and enjoying many coffee shops and parks. The community leans conservative, and the public schools are highly rated.

Real Estate Insights, Home Tips & More

Bergen County Real Estate Market Update: What’s Really Driving Home Prices in 2025?

Bergen County Home Prices Continue to Rise — But There’s More to the Story

Yes, Bergen County home prices are still climbing but as local Realtor Stacy Esser points out, looking at sold prices alone is like looking in the rearview mirror. To really understand what’s happening in today’s market, you have to look at leading indicators: price reductions, days on market, and buyer demand.

Through September 2025, average list and sold prices in Bergen County are both up about 12% year-to-date, with the median sold price increasing by roughly 10.4%. These numbers reflect a market that remains strong — but the data hides an important story beneath the surface.

What’s Really Driving the Bergen County Housing Market?

Behind those strong price increases, many sellers who don’t get their desired price are quietly taking their homes off the market rather than reducing. This “shadow inventory” makes it appear that sellers are firmly in control, when in reality, there’s a subtle tug-of-war happening between buyers and sellers.

Inventory remains exceptionally tight, which continues to place upward pressure on prices. Bergen County isn’t following the same trend as other national markets experiencing slowdowns — and the limited housing supply here is keeping things competitive.

Buyer Behavior: When the Price Is Right, Demand Follows

Homes that are priced correctly are still selling quickly and often above their listed prices. But when homes sit on the market longer, sellers are more likely to withdraw and re-list rather than negotiate.

This creates the illusion of a seamless market, but in truth, it’s a sign of buyer hesitation and affordability challenges. As days on market increase by 30–40 days in some cases, the market shows small but meaningful signs of cooling momentum — even as prices stay high.

Affordability Challenges and the Missing First-Time Homebuyer

The biggest shifts are happening among first-time buyers, who are struggling with affordability in Bergen County’s high-cost market. Many entry-level homes are being bought by developers, squeezing out younger buyers and contributing to the shortage of move-in-ready starter homes.

However, there’s a silver lining: mortgage rates are finally trending lower. As of mid-October 2025, average rates are around 6.25%, down from nearly 7% this time last year. This drop in rates could reignite buyer activity and make homeownership slightly more attainable particularly if the downward trend continues through the end of the year.

Looking Ahead: What Will Shift the Bergen County Real Estate Market?

Until inventory increases or affordability improves, Bergen County home prices are likely to remain stable or climb modestly. Lower interest rates could encourage more sellers to list and more buyers to enter the market, helping to balance supply and demand.

As Stacy explains, buyers don’t purchase a home price, they purchase a monthly payment. The moment those payments become more manageable, the local market could see a surge of new activity.

Key Takeaways for Bergen County Homeowners and Buyers

Prices remain strong: Up 10–12% year-over-year through September 2025.

Inventory is still tight: Keeping pressure on prices despite fewer active buyers.

Days on market are rising: Subtle signs of a market shift.

Affordability remains the biggest barrier for first-time homebuyers.

Falling mortgage rates could ease some of that pressure and spark renewed activity.